Don't you want to read? Try listening to the article in audio mode 🎧

If you are a medium to small investor, you’ve probably never considered investing in a startup: too risky, too difficult, too big an affair. This may have been true some years ago, but now everything has become simpler. There are platforms devoted to making the marriage between startups and possible investors happen and you know where to go to discover new and interesting startups: Wefunder, SeedInvest, StartEngine, Republic, AngeList, you just have to take your pick.

Coming to the matter of how to choose the right startup, now that is a big problem, because startup investing is for sure a risky business.

Startup investing: what you need to know before you start

First of all we think it is important to clarify some terminology. A startup is a very young private company that is expected to grow very quickly. When you invest in a startup, you buy a portion of the company and rights on its future profits. This portion is called an “equity”. Of course if the company fails, you completely lose your money. Also, if you want to sell your equities, with startups it may not be so easy, because these kinds of equity have a low liquidity. You gain when you sell your equities during “liquidity events”, namely opportunities to convert money freezed into equities into cash. Common liquidity events are acquisitions or IPOs (initial public offerings, when the startup “goes public”). You can try to sell your stocks before the IPO, but the company may refuse. Some companies decide to never go public. In that case there is no IPO but if the company is generating lots of profit it can decide to repurchase its shares or to issue dividends. Of course you understand that investing in a startup is an extremely risky but potentially rewarding operation. So if you decide to do that, consider the risk of not seeing your money back.Venture capital vs. Angel capital vs. Crowdfunding

And now let’s try to understand what kind of investor you are. Do you have a HUGE amount of money to invest? If not, then you cannot be a venture capitalist. This kind of investor usually puts big sums on the startups they choose to fund (we are talking more than 1 million dollars, with the median being around 18 millions) and in exchange they get a place or more than one place on the company’s board. On the contrary Angel investors are usually private investors who put smaller amounts of money on the table (starting from around 10.000 dollars). In any case you should be an “accredited investor” to be an Angel (for example to be an Angel you should earn at least 200.000 dollars per year and have a net worth of $1 million or more). As an angel investor you can participate in an Angel group or in an Angel Syndicate (like AngeList), where one expert investor leads all the others. Lastly, you can crowdfund a startup, and this is the easiest, less risky and smaller form of funding, because you can put a really small amount of money on the company. Thanks to the “Jumpstart Our Business Startups Act of 2012” some restrictive regulations fell, so even the smaller investor could buy startups shares.How to choose the right startup

Being a risky business you should choose carefully. First of all you should concentrate on a domain you know, because that will help you to understand if what the startup is doing is sensible. You should investigate the market (competitors, etc), look at who the other investors are (if they have a success record for example) and you should also have a very clear understanding of your monetization needs (do you need your money back quite early?) and the monetization strategy of the company. Also have a look at the company’s financials and how they use the funds (e.g. if they invest the majority in salaries, that would not do). Scan through the legal documents. And, finally, follow your gut...in the end, that’s what a true investor does, isn’t it?

Article updated on: 09 August 2023

Don't Waste Your Talent. Turn It Into a Career With a Course That Fits Your Needs!

Talent Garden is your Digital Skills Academy, offering courses in Digital Marketing, UX Design, Digital HR and Data Analysis designed to launch your career.

Keep reading

2

min read

Introducing Europe’s largest coworking network: Talent Garden closes €12m funding round

Coworking network Talent Garden today announces a new €12M funding round(debt and equity). With investors including 500 ...

Talent Garden

14/11/2016

%20(3).jpg)

2

min read

Talent Garden and The Social Hub together to write a new chapter of edtech in Europe

The industrial partnership between Talent Garden, the largest digital academy for digital skills, and The Social Hub, ...

Talent Garden

11/12/2023

11

min read

12 AI-Powered Marketing Tools to Revolutionise Your Strategies in 2024

Are you ready to enter the exciting world of AI-powered marketing? It is a place where innovation and efficiency ...

Talent Garden

12/09/2023

2

min read

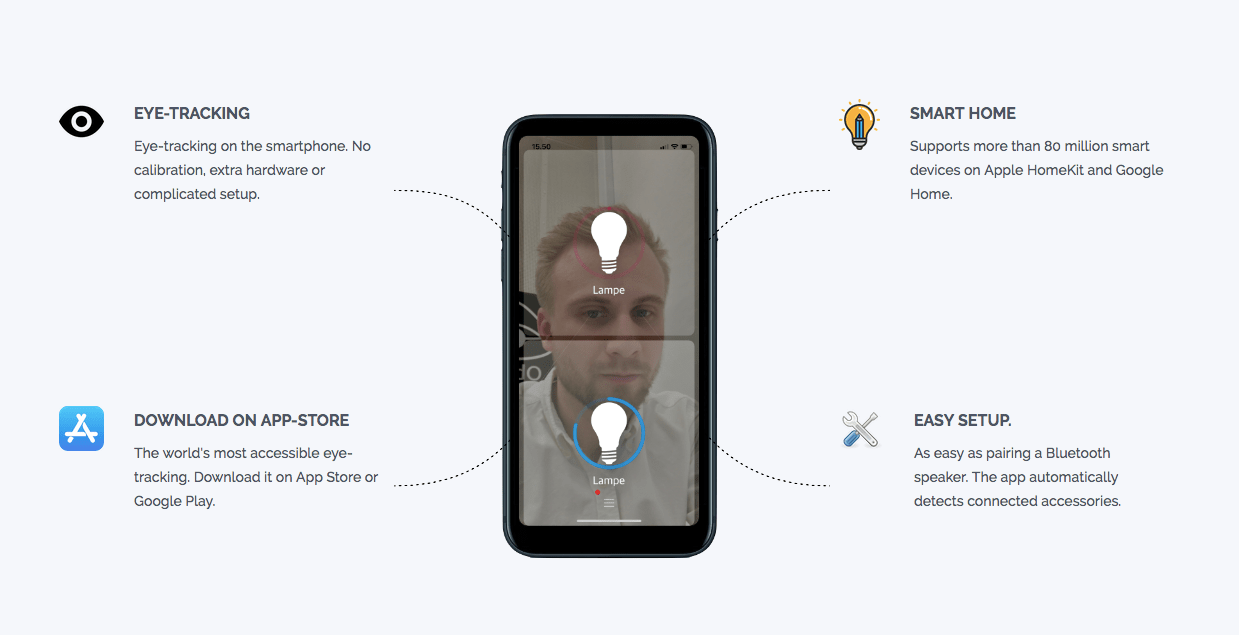

The Best Technology Works For Everyone: Interview with Frederik Østergaard Neble the CEO & Co-Founder of Obital

Founded in 2017, Obital was a spin out of the Technical University of Denmark. They have invented an enabling ...

Talent Garden

06/05/2019